This is why last year’s 45% decline in auction sales of paintings valued at more than $10 million should not come as a surprise– especially since there was a similar, if less drastic, decrease in 2023. Economic uncertainty and high interest rates are easy scapegoats but not an altogether convincing explanation for the drastic dip. After all, wealthy Americans are richer than ever before, with the top 10% adding $37 trillion to their wealth since 2020. And, those who purchase art often do so for the love of it, rather than as a high-yield investment.

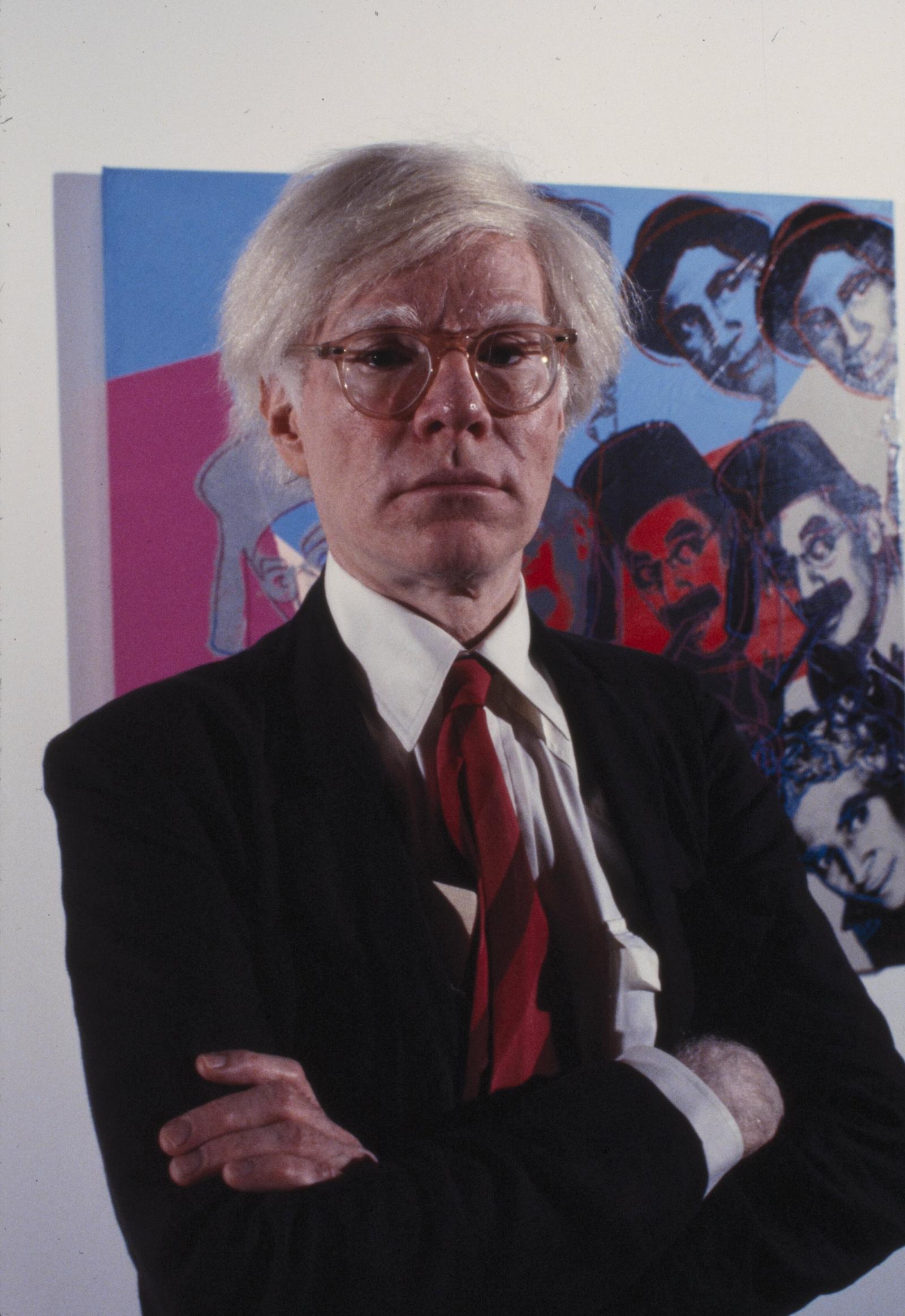

A more compelling reason for shifts in high-end auction sales is the emergence of a younger and more diverse collector cohort. Gen Z and Millennial buyers are not showing the same interest in work that their Gen X or Baby Boomer equivalents gravitated towards—and are now trying to sell.

Women’s increased purchasing power may also be a contributor. Almost 70% reported being their household’s primary investment decisionmaker in 2024. At the same time, women are less likely to purchase art valued at more than $1 million, even though they have spent more on art than men in recent years. Combine this with a general preference for art by or of women (very little of which exists above the $10 million mark) and you have a vastly different buyer profile than even a decade ago. The same goes for collectors of color. In a post-white male buyer world, “trophy art” is gathering dust.